Cryptocurrency Dictionary: What about Monero

by CryptoAddicted ·

Monero is a brand new uprising cryptocurrency which originates from Bitmonero and is a secure, private, untraceable currency.

What about Monero? Being the fork of Bytecoin, Monero (XMR) is an anonymous and decentralized cryptocurrency with CryptoNight (64-bit CPU-only) PoW hash algorithm and based on CryptoNote protocol. It was fairly launched on April 18th, 2014, without premine or instamine. The technology behind Monero has already spiked the interest of several established people in the Bitcoin development world and the cryptography community. Monero development is completely donation-based and community-driven, with a strong focus on decentralization and scalability. With Monero, you are your own bank. Only you control your funds, your accounts and transactions are kept private from prying eyes.

How to store and earn some Monero?

The fastest way to start using Monero is with a web account manager such as MyMonero. Alternatively, if you would like to run a full Monero node, you can download the client and a kick-starter blockchain.

To earn it, of course you can mine it through MinerGate and using also the possibility to mine 2 currencies at the same rate (e.g. Monero and FantomCoin). And you can buy a cloud mining conctract from Genesis Mining or HashFlare.

The full mining pool list is here.

Detailed information

While most cryptocurrencies align to theoretical principles of decentralization, the reality is that most fall short of such a claim.

With Proof of Stake currencies, irregular emission and distribution models cause most of the staking power to end up in the hands of a privileged few.

With Proof of Work currencies, of which Bitcoin remains the most significant reference, the mining process remains largely in a handful of pools. This centralization of mining power, combined with a transparent blockchain, has already lead to various occurrences of transaction censorship.

Monero contrasts with these examples in various and meaningful ways. Monero is powered strictly by Proof of Work, but specifically, it employs a mining algorithm that has the potential to be efficiently tasked to billions of existing devices (any modern x86 CPU).

This very characteristic has the potential to ensure that for long years to come, the process of mining new Monero coins is within reach of the common individual, not an exclusive opportunity to the owners of large mining operations.

One of the problems with cryptocurrencies is scaleability. Most cryptocurrencies are derived from the Bitcoin codebase and thus have a “block size limit.” This limit has become a big issue in the Bitcoin community and led to fierce discussions.

Monero doesn’t suffer from this block size debate. It has a dynamic block size limit and implements a “permanent block reward.”

The block reward will never drop below 0.3 XMR, making Monero a disinflationary currency. The inflation will be roughly 1% in 2022 and go down forever. The nominal inflation will stay at 0.3 XMR per minute. This means that there will always be an incentive for miners to mine Monero.

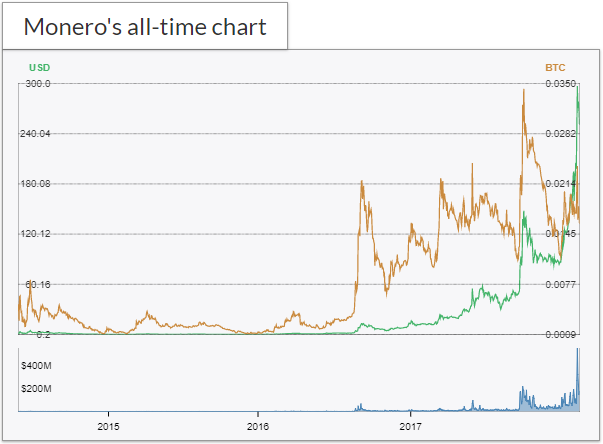

As of December 10, 2017, its market capitalization in US$ is equivalent to 3.802.782.084 at around $246.15 per monero and with 15,449,232 XMR circulating supply.

Other useful links

Find general information as well as a list of services and exchanges that support Monero at Monero.org , in particular on the Exchange Service page and on Wikipedia. Alternatively you can use the Cryptopia exchange platform.

You can follow them on Reddit.

Besides the “What about Monero” post, you can find more cryptocurrency articles browsing our CryptoAddicted Blog.

Thanks to Cryptoaddicted.altervista.org for the information.

HTH,

CryptoAddicted team.